Where should Loss Prevention report into?

That is a great question, and there is no consistency between retailers for various reasons. So it is not a simple answer.

There is very little standardization of the actual loss prevention function as a profession. There is no professional association, there are no Colleges, and there is limited oversight from a Regulatory Official.

There are provisions that speak to the crime of theft and fraud, and how to make an arrest, but not how to protect your business with the use of these assets we know to be loss prevention professionals (Criminal Code of Canada). But there is no real guidance as to where the function should sit within an organization.

Some retailers try to prevent all thefts and dissuade thefts in progress, while others arrest 10’s of thousands of people each and every year.

Some loss preventers are responsible for everything on the “L” side of a P&L, while other only walk the sales-floor monitoring for shoplifters.

Some companies give visibility to everything confidential, while others don’t even give the store keys to the loss prevention staff.

So it is no wonder there is confusion as to where the function should sit within the organization.

Operations? Human Resources? the CEO? The COO? Marketing? (yes, one organization even has LP reporting into marketing!)

I’ll give you all the pros and cons, the ideal scope of responsibility and the Bottom Line … where it should report. And this is not based on a bias, it is simply observing existing law, and seeing how an organization might want to govern themselves to comply to the best of their ability.

So the bottom line. Where should it report?

Finance!

Ideally, Loss Prevention reporting to the Chief Financial Officer covers many of the regulated requirements of a publically traded company.

Loss Prevention reporting to Finance establishes objectivity and ensures that there are no compromises in the quest to maximize the bottom line in compliance with legal requirements.

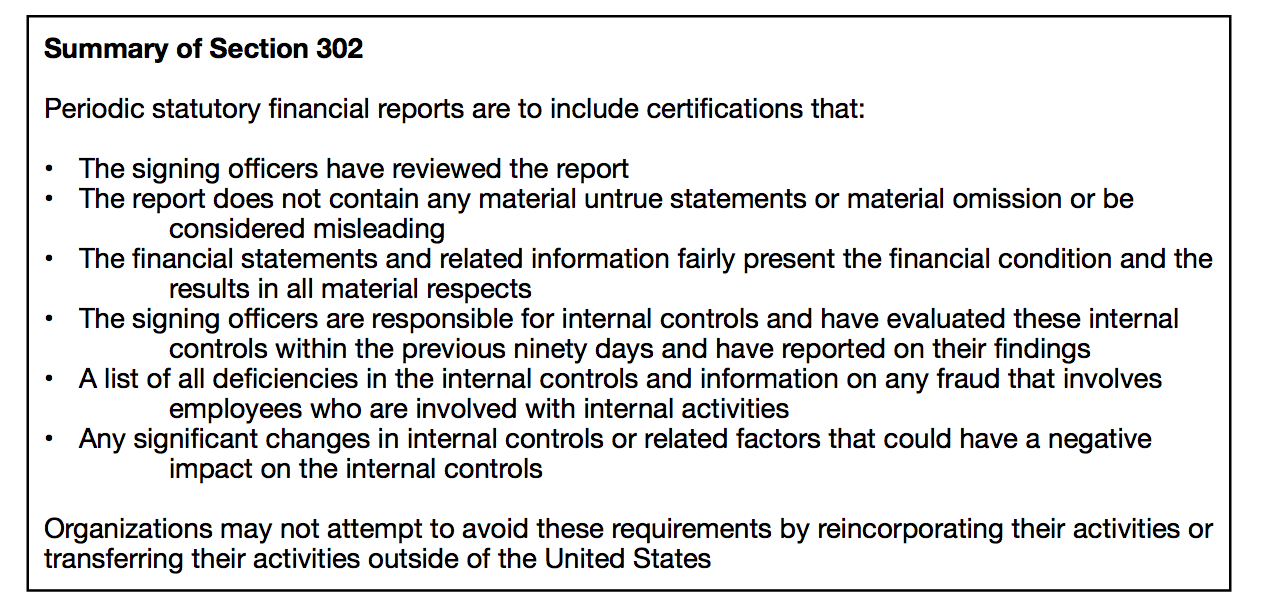

Let’s take a look at some common language in any anti-corruption legislation. Most countries have this type of law and language, and it is primarily to protect investors in public companies from losing their nest egg at the hands of corrupt or irresponsible business people.

I am going to use a U.S. law called Sarbanes-Oxley because it extends to subsidiaries of U.S. parent companies and there are many U.S. based retail companies in Canada. While SOX speaks specifically to fraud, there are elements of “internal controls” which result in positive or negative shrink depending on the quality of the controls. Theft results from a lack of control.

Sarbanes Oxley has the following language that relates to the signing officer, typically the CFO.

Data Source: Sarbanes Oxley Act

I often compare Loss Prevention to a good shock absorber on a car.

It (the Loss Prevention department) isn’t absolutely necessary and you don’t know it is there until it is taken away, for it makes for a much smoother ride when it is around.

Having Loss Prevention report to the right area will make sure it is set up for the best success possible.

Loss Prevention is a resource, and from a business standpoint, allocating your resources to the appropriate business initiative gives the best bottom line. This is no different.

Now here are the other options and the pros and cons;

Reporting to the CEO:

Pro:

Makes a statement that the function is important.

CEO is the final decision maker in any organization.

Con:

CEO may not have the time to allocate to the individual leadership aspect

Places the CEO in direct line with decisions. Upon conflict who is next in line to be the referee? The Board!

Reporting to Human Resources

Pro:

Loss prevention always involves people issues; training, investigations into dishonesty, termination, prosecution.

Con:

Human Resources must remain objective

The nature of loss prevention sometimes carries a negative stigma that by association may be conflicted with the intention of an HR mandate.

Reporting to Operations

Pro:

Operations have the largest proportion of the overall headcount and by extension, can impact the organization to the greatest degree.

Con:

Operations is where the action is and the head of the division having to always answer to thefts and fraud may result in a senior operator directing a crime to be swept under the rug.

These are but a few examples to allow you to begin the process of evaluating this within your own organization. The decision must be more than one of supervision. If you want to protect your bottom line, and Loss Prevention is an enabler and an element in the foundation of the company, then the appropriate evaluation of this organizational structure is certainly warranted.

The Bottom Line

If you want to keep it simple, and just want the bottom line, then the answer is this – the person who signs the books! They are putting their name on the line, and in turn, will make sure you have the best Loss Prevention team around!